What Went Wrong for Nike?

The news about Nike CEO John Donahoe's departure shocked the industry--and not at the same time. We break down what went wrong, and how Nike can rectify their course.

Last week, the news about Nike CEO John Donahoe's departure shocked the industry--and not at the same time. The marketplace rejoiced, with shares jumping up to 10% after the announcement, and LinkedIn was inundated with current and ex-employees celebrating the start of a new Nike era.

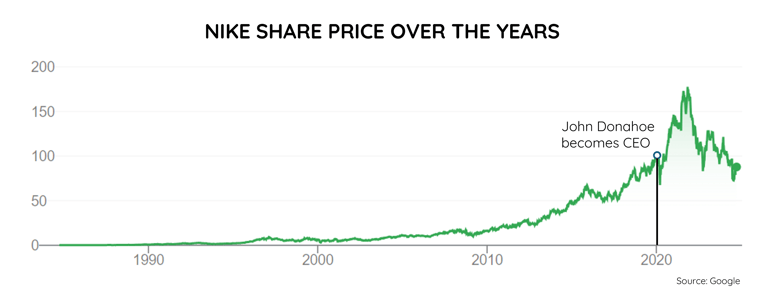

But if you read about the results under Donahoe's tenure, his leadership seems like a success: he helped Nike navigate the Covid pandemic--a tricky time for all businesses big and small--and sales improved by about 25%. In 2023, Nike announced record sales of $50 billion, which again is impressive, this time due to the global financial slump. Under his tenure, Nike shares hit a high of $178 in 2022, the brand's all-time high.

So where did it all go wrong for Nike? How did it all come crashing down so quickly, not just in value but in brand reputation, so much so that Bloomberg called Donahoe "the man who made Nike uncool". Here, we break it down into categories to understand what happened, both the good times and the bad.

The Man Himself

Having previously worked in Bain and eBay, Donahoe was a techie with consultancy experience--perfect candidate to help Nike realise their dream of technological and eCommerce growth while remaining cost-efficient. Donahoe had met and worked with Phil Knight, Nike's founder and former CEO, and was also a confidante of Apple CEO Tim Cook, so Donahoe's credentials were solid, which is why he became the leading candidate when Nike were on the hunt for a new CEO to help realise their ambitious revenue goal of $50 billion.

In the age of digital growth, a CEO with tech expertise is a wise decision. With Donahoe's eBay experience, he brought a lot of valuable eCommerce insights and initiatives to the table. But it became clear that, where he excelled in digital knowledge, he lacked retail acumen. Fashion retail may seem like a creative world, but true success is marked by science and calculations that the average public are not aware of. Donahoe didn't seem to understand that trends were trends because of scarcity, that trends fall as quickly as they rise. But most importantly, he seemed to lose sight of Nike's true brand identity: as a leading sports performance innovator. And as we will see, these are all big reasons for the quick decline of the brand.

Wholesale Distribution Overhaul

Think about when you've gone shopping on the high street, and think of how many different retailer you've seen Nike sold in. In the UK, you could go into a John Lewis, a JD Sport, a Schuh and a Sports Direct, and you'd see Nike assortments. This is because Nike had a wide wholesale distribution network, where they would partner with a lot of different retailers to showcase and sell their products.

When Donahoe came onboard, one of his first initiatives was to turbo-charge Nike's D2C business. Dubbed "Consumer Direct Acceleration", it was all about investing in Nike's back-end eCommece operations and steering customers towards Nike's own stores and website, and to do this, they looked at tightening their wholesale network and reviewed which partners they wanted to work with, to ensure their brand was presented in the right way.

This in itself is not a terrible idea at all. Often referred to as "cutting the tail", many brands do this to sever ties with unproductive partners. When a brand first starts, you want to be stocked in as many locations as possible, so as many customers as possible can see, get to know and hopefully purchase your product. But when you get big enough, you can afford to be picky, so you only work with high value partners.

And from Nike's perspective, their D2C drive worked. Traffic to their stores and webstore shot up, their D2C business grew by almost $9 billion in 3 years, and their gross margin grew by 2 percentage points. They even hit their $50 billion revenue target in 2022, so Donahoe achieved what he came onboard to achieve.

But one massive side effect that was not considered was that this wholesale tightening inadvertently helped Nike's competitors. From Nike's perspective, they were simply losing (who they considered) unproductive partners; from the partners' perspectives, they had lost their money-making product line and shelf attractions. But the show must go on, so to fill those empty shelves and display spaces, retailers turned to Nike's competitors like Adidas, Under Armour, New Balance and even UGGS to make up for that display and revenue black hole. This had the unintended effect of promoting Nike's rivals for the general purchasing public. If you're a die-hard Nike sneakerhead, you will make the transition to go shop on Nike.com for the latest kicks; if you're an average shopper who just needs a new pair of trainers, you will buy whatever is available. And so if Nike isn't available in your retailer of choice, you will simply buy another brand.

It isn't even like Nike cut the tail on small independent retailers (not saying that would make things better); they cut ties with the likes of Urban Outfitters and even Foot Locker, one of the biggest trainer retailers in the world. Allegedly this is because Donahoe didn't like how Foot Locker presented Nike products, which in a way is a valid concern, but in a way isn't, because with a large retailer like this, you lose a lot of casual customers.

And in the end, Nike have had to admit that they went too hard on their move away from wholesale, with Donahoe admitting in April this year that "we had over-rotated away from wholesale a little more than we intended".

Overreliance on Trends

One of the reasons why Nike's shares rose in 2021 was due to the release of the Panda Dunk, an 80s-inspired low-top basketball shoe. It was an incredible success, selling out quickly, and became one of the most sought-after trainers by sneakerheads and fashionistas alike.

So Donahoe took this as a sign that the Panda Dunks are here to stay, and Nike were pumping out new colour-ups of these trainers. This may sound like a reasonable business decision; after all, why not back your winning horse?

The problem was the overreliance on the trend. Anybody who has worked in fashion will tell you that trends fall as quickly as--or even quicker than--they rise. So yes, absolutely capitalise on your trend, but don't rest on your laurels and always have something in the background, ready to launch when the trend starts to dip. And if you flood the market with that trendy product, you can guarantee that that trend will drop off a cliff. Trends by definition are items that are desirable because they are not yet adopted by the mass market, so it's its scarcity that makes it trendy; once you make a trending item mass market, it loses its trendy credentials.

So when Nike flooded the market with different colourways of the Dunks, it became the trainer that everybody bought because it was cool. Soon, it wasn't just the trendsetters who wore them in the throwback to the 80s; now everybody, from office workers to maybe even your parents. As Matt Welty wrote on Complex, "in a sneaker world that usually champions individuality, it’s a little lame to see everyone flock to the same shoe, whether they’re super into sneakers or not".

That's fine to cash in and ride the wave. But what's next? When the Dunks are no longer cool, what product will make Nike cool again? As we will see, Nike went through an innovation stall, and this meant there was nothing in the wings to take over. Furthermore, by association, because the Dunks were no longer cool, Nike were no longer cool. Hence the GQ article that inspired that scathing Bloomberg headline.

Innovation Stall

As Donahoe started his tenure pretty much at the start of the Covid pandemic, his view of the fashion world was perhaps skewed. He was running the company in an era when comfort was every shoppers' priority. And so Nike's focus was on their casualwear range, because that was where the money was

However, this is a huge injustice to Nike's true heritage. Yes, we might associate Nike with weekend tracksuits and casual trainers, but Nike started off as an innovator in running footwear technology (would highly recommend Phil Knight's book Shoedog to learn about Nike's history). Since then, Nike have been on the cutting edge of performance technology and innovation, such as their sweat-wicking Dri-FIT technology, or their lightweight Flyknit fabrics, or their Air footwear cushioning. Nike were market leaders in the sports industry because of these inventions and their continued quest for athletic perfection. But under Donahoe, this innovation stalled.

This was also not helped by Donahoe's cost-cutting restructuring and management style. According to Bloomberg, this was a huge reason for the brain drain, resulting in designers and technicians moving to competitors such as Adidas and Under Armour as well as newbies On and Hoka. 10 years ago, if you asked runners for their footwear recommendation, chances are Nike was at the top of the list; nowadays, people tend to recommend On, Hoka and ASICS. Nike will always crack the top 10, but they are no longer leaders of the pack. And for a brand with Nike's reputation, this is incredibly dangerous and worrying.

So what's next for Nike?

Nike have announced that Elliott Hill will be coming out of retirement to take Donahoe's place as Nike's CEO. The news has been widely praised, and has certainly injected some positivity and excitement into the future of Nike. Hill was a veteran at Nike for 32 years, thus has a wealth of Nike knowledge and an appreciation for the brand's heritage. But he's not the only veteran who has been brought back onboard: Tom Peddie, with 30 years' Nike experience, is returning (also out of retirement) as VP of Marketplace Partners, and Nicole Hubbard Graham, who left Nike in 2021 after 17 years, has returned as Chief Marketing Officer. By turning to the old guard, it shows that Nike are ready to return to their roots and rediscover their heritage.

For all of its errors, Nike isn't going away, and we don't want them to either. With the return of the veterans and the newfound buzz of excitement around the brand, pressure is on for Hill and Co. to show that they have that Midas touch to turn the ship around. Change will not be immediate, so watch this space over the next year--we cannot wait.

If you liked our analysis and want help with your business' strategy, get in touch and see how we can help you grow our business in a sustainable and organic way.